irs tax fourth stimulus checks dependents

Thats 300 per month and 250 per month respectively. Apr 2 2021 1212 PM EDT.

Fourth Stimulus Check Democrats Call For Recurring Payments 11alive Com

If the income is above that threshold.

. This plan is established partly due to the peoples evident need for assistance due to the pandemic especially now that COVID-19 cases are continuously elevating as the new variant speeds up the infection. The latest round of stimulus checks will allow people to use the later of their 2019 or 2020 tax data file your tax return via TurboTax to ensure the latest dependent and payment information can be usedFurther the new legislation has expanded the. Millions of Californians received a second round of Golden State Stimulus checks for 600 up to 1100 and low-income Marylanders are eligible for direct payments of.

On petition for 4th round of stimulus checks. In this case the IRS will make sure to send. Actual payment or deposit of these funds could go into early 2022.

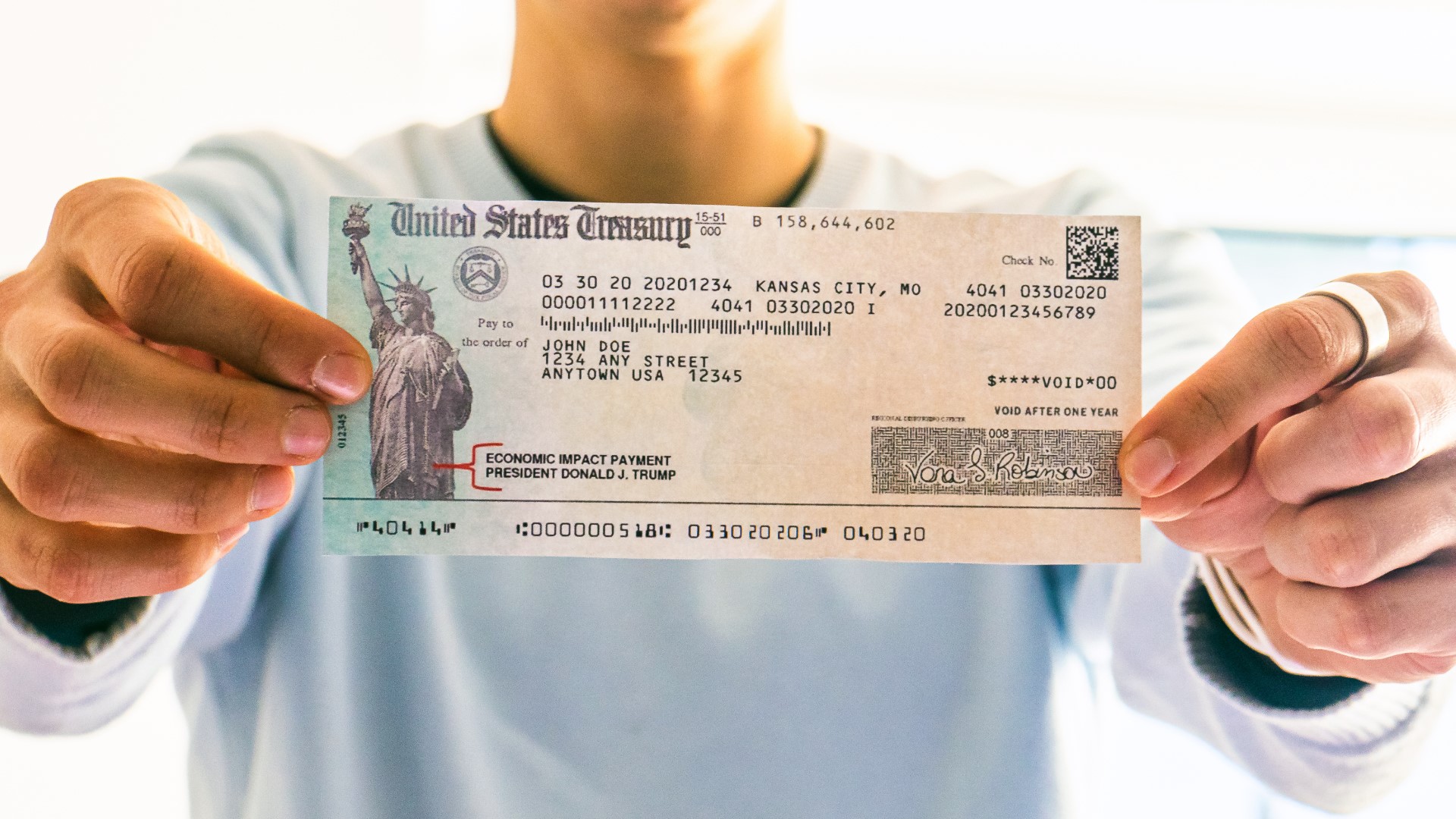

The payments will be 1400 per qualifying adult 2800 for married taxpayers filing a joint return and 1400 per dependent. Eligible residents in at least 18 states are getting tax rebate checks. 600 in December 2020January 2021.

These plus-up payments generally covered situations. Time is running out for Massachusetts Gov. The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first 1200 stimulus check or the second 600 payment if that money.

The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first 1200 stimulus check or the second 600 payment if that money is. COVID-19 Stimulus Checks for Individuals. Also according to the IRS the payments are not an advance on your tax refund.

For the third round of stimulus payments taxpayers can get payments for dependents of all ages including children over the age of 17 college students and adults with disabilities. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. So a person who adds a parent or grandparent or another eligible dependent to their household could also be eligible for a 1400.

Armed Forces at any time. Rebates are available for residents making less than 200000 per year 400000 per couple filing jointly. Even you may file a tax return for the year 2020 then the IRS will get information on your 2020 tax return.

The stakes have changed. The IRS has been making millions of catch-up or plus-up payments to those who have filed recent tax returns or updated paymentdependent information. This will be for a child they obtained in 2021.

How much was the third stimulus check per child. For the first stimulus payment the IRS looked at both 2018 and 2019 tax returns and sent 500 per child age 16 or younger if you claimed dependents either year which. The Internal Revenue Service IRS plans to distribute fourth stimulus checks as part of the American Rescue Plan Act by the government.

Dependents rules for stimulus checks are wildly different from the child tax credit which is worth even more -- up to 3600 per qualified. 1400 for an eligible individual with a valid Social Security number 2800 for married couples filing a joint return if both spouses have a valid Social Security number or if one spouse has a valid Social Security number and one spouse was an active member of the US. After that stimulus checks phase out.

2021 Third Stimulus Check Income Qualification and Phase-out Thresholds Limits Expanding Dependent Eligibility. Households who are eligible for the tax credit must have an adjusted gross income of up to 125000. So it is still possible to get a stimulus check if you were claimed as a dependent in 2019.

Irs tax fourth stimulus checks youtube. NEXSTAR A fourth stimulus check could lift over 7 million people out of poverty according to. The third Economic Impact Payment amount was.

It all started back when the American Rescue Plan rolled out. Each individual will receive 50 with an additional 100 per eligible dependent up to three kids per family. 1200 in April 2020.

But you get a third stimulus check and then your 2020 tax return is being filed and processed now. The expanded child-tax credit provides up to 3600 per child under age 6 and up to 3000 per child age 6 through 17. 1400 in March 2021.

These Plus-Up Payments are set to be distributed up until December 31 2021. Because the stimulus payments in 2020 and 2021 are considered tax credits the payments are not considered as income. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Charlie Bakers plan to send taxpayers a. To receive the full 1400 check head of households have to earn no more than 112500 a year while married couples must make no more than 150000. The criteria to receive a 1400 payment.

Fourth Stimulus Check What S The Status Weareiowa Com

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

Fourth Stimulus Checks For Seniors Why One Group Says Payments Are Vital

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

How To Get A Stimulus Check If You Don T Have An Address Bank Account

Is A Fourth Stimulus Check Arriving In 2022 Al Com

Fourth Stimulus Check White House Says Possible Payment Up To Congress Wpri Com

How College Students Can Get Stimulus Money The Washington Post

Even Without Fourth Stimulus Check Millions Of Americans To Receive More Money This Summer

Stimulus Update Will A Fourth Stimulus Check For 2 500 Arrive On July 30 Silive Com

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

Where S My Third Stimulus Check Turbotax Tax Tips Videos

How To Claim A Missing Stimulus Check

Third Stimulus Check Update How To Track 1 400 Payment Status 13newsnow Com

Fourth Stimulus Checks The Push For Future Rounds Continues But Here Are Some Ways You May Receive Payments Pennlive Com

Irs Get My Payment Tool Lets You Track Your Stimulus Check

Will My 4th Stimulus Check Be Affected If I Owe Child Support And Taxes

Will There Be A Fourth Stimulus Check Here S The Case Against It